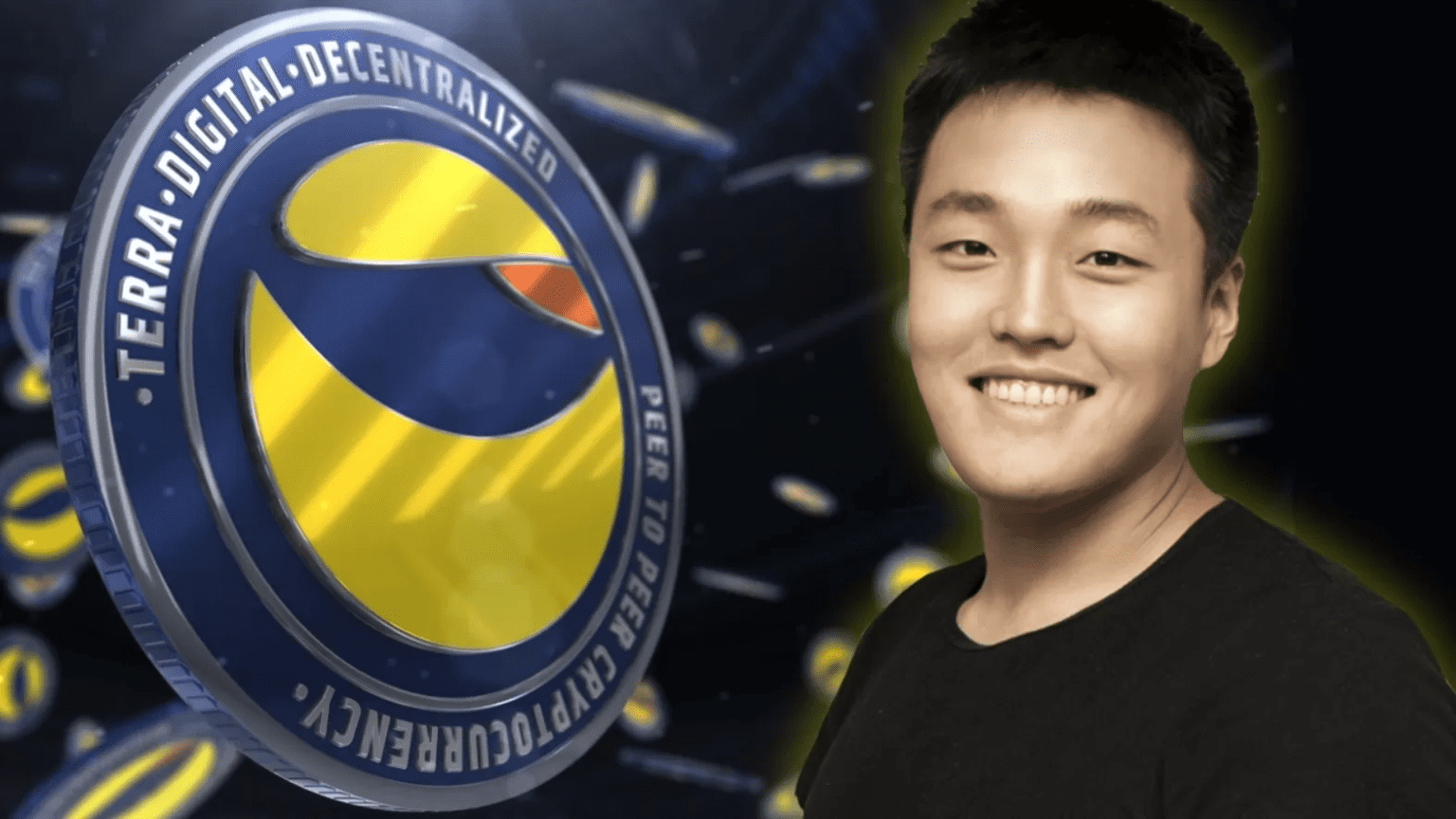

In the Terraform Labs case, one of the major scandals that shook the cryptocurrency world, the United States Securities and Exchange Commission(SEC) took a new step in the litigation process. The SEC has filed a lawsuit against Terraform Labs and its founder, Do Kwon, seeking massive damages. Stating that a total of 4.7 billion dollars should be paid, the SEC demanded an additional 520 million dollars from Terraform Labs and 100 million dollars from Do Kwon. Thus, a total penalty package of almost 5.3 billion dollars has emerged. In addition, the SEC requested that Do Kwon be barred from the markets and that Terraform Labs be granted an injunction.

In return, Terraform Labs and Do Kwon offered to pay a smaller fine. Terraform Labs agreed to pay a maximum fine of $3.5 billion, while Do Kwon recommended a fine of $800,000 to the court.

UST’s Collapse and its Impact on Crypto Markets

This case concerns the collapse of Terraform Labs’ stablecoin UST. UST used an algorithm instead of fixed asset backing like other stable coins. This algorithm reacted unexpectedly, reducing the value of UST from $1 to $0.05. This led to the evaporation of investors’ money and a historic collapse in cryptocurrency markets. Do Kwon surprised the public with his statements after his arrest, downplaying the situation by saying that he had gambled and lost. These developments have brought serious debates on the future of the cryptocurrency market.